dariomilano

novellino

Why Italian Bonds Have A Long Way Down To Go | Zero Hedge

Una delle maggiori vittime degli effetti collaterali delle politiche giapponesi sono e saranno i titoli di stato della periferia europea (spagna, italia, portogallo).. chi infatti acquisterà questa spazzatura (nella quale i fondi pensioni spagnoli sono andati all in) quando il carry trade giapponese, i soldi facili giapponesi in cerca di rendimenti in europa, cessa?

Ma il punto principale della questione sono le sofferenze bancarie (i prestiti che non vengono rimborsati) che continuano a peggiorare!

As we hinted last night, and as the market is starting to realize, one of the bigger downstream casualties of the first rumblings that Abenomics is starting to crack, have been peripheral bond yields, with Spanish, Italian and Portuguese yields all wider by 10 bps and rising: after all who will buy this worthless garbage (in which Spain's pension fund has gone all in) if the Japan hot money flows stop or even reverse?

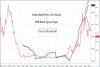

However, that is only half the story. The other half is that, with its usual 6-8 week delay, the market is finally grasping the biggest danger in Europe - one which we have been pounding the table on week after week after week (most recently here): the soaring non-performing loans held by European banks. In fact, it took the FT to confirm what we have been warning about all along. And just so the market has a sense of how much downside may be imminent if indeed reality reasserts itself and frontrunning the Japanese carry trade both occur at the same time, here is a rather unpleasant chart courtesy of Diapason, of what expects all those who bought up Italian bonds in the recent dash-for-trash, oblivious of the collapsing fundamentals, and driven purely by FOMO. The downside could be big to quite big.

Una delle maggiori vittime degli effetti collaterali delle politiche giapponesi sono e saranno i titoli di stato della periferia europea (spagna, italia, portogallo).. chi infatti acquisterà questa spazzatura (nella quale i fondi pensioni spagnoli sono andati all in) quando il carry trade giapponese, i soldi facili giapponesi in cerca di rendimenti in europa, cessa?

Ma il punto principale della questione sono le sofferenze bancarie (i prestiti che non vengono rimborsati) che continuano a peggiorare!

As we hinted last night, and as the market is starting to realize, one of the bigger downstream casualties of the first rumblings that Abenomics is starting to crack, have been peripheral bond yields, with Spanish, Italian and Portuguese yields all wider by 10 bps and rising: after all who will buy this worthless garbage (in which Spain's pension fund has gone all in) if the Japan hot money flows stop or even reverse?

However, that is only half the story. The other half is that, with its usual 6-8 week delay, the market is finally grasping the biggest danger in Europe - one which we have been pounding the table on week after week after week (most recently here): the soaring non-performing loans held by European banks. In fact, it took the FT to confirm what we have been warning about all along. And just so the market has a sense of how much downside may be imminent if indeed reality reasserts itself and frontrunning the Japanese carry trade both occur at the same time, here is a rather unpleasant chart courtesy of Diapason, of what expects all those who bought up Italian bonds in the recent dash-for-trash, oblivious of the collapsing fundamentals, and driven purely by FOMO. The downside could be big to quite big.

Allegati

Ultima modifica: