Stai usando un browser molto obsoleto. Puoi incorrere in problemi di visualizzazione di questo e altri siti oltre che in problemi di sicurezza. .

Dovresti aggiornarlo oppure usarne uno alternativo, moderno e sicuro.

Dovresti aggiornarlo oppure usarne uno alternativo, moderno e sicuro.

Obbligazioni perpetue e subordinate Sns Reaal e Sns Bank - Ricorso legale - Legal Claim - Class Action (1 Viewer)

- Creatore Discussione Zorba

- Data di Inizio

Zorba

Bos 4 Mod

In questo post inseriremo i documenti relativi alla nazionalizzazione.

Descrizione di cosa è successo

SNS REAAL nationalised by Dutch state | Norton Rose

Il decreto di esproprio (fonte governo olandese) http://www.government.nl/documents-...onents-of-sns-reaal-nv-and-sns-bank-nv.html):

in lingua originale Minister Dijsselbloem nationaliseert SNS REAAL | Toespraak | Rijksoverheid.nl

tradotto in inglese Vedi l'allegato decree-by-the-minister-of-finance-regarding-the-expropriation-of-securities-and-capital-componen.pdf

La lettera al parlamento (fonte governo olandese, in inglese qui e in lingua originale qui)

in lingua originale Vedi l'allegato kamerbrief-over-de-onteigening-van-sns-reaal.pdf

tradotto in inglese Vedi l'allegato letter-to-parliament-concerning-nationalisation-of-sns-reaal.pdf

La perizia del Ministro che quantifica l'indennizzo a zero.

Vedi l'allegato petition-to-enterprise-chamber-to-determine-compensation-dated-4-march-2013-unofficial-english-t.pdf

La sentenza del Consiglio di Stato Olandese

Vedi l'allegato Sentenza Consiglio di Stato.pdf

Il comunicato della società con la presa di distanza dal provvedimento e le dimissioni del board

SNS REAAL NV announces that its Executive Board members Messrs Ronald Latenstein, CEO, and Ference Lamp, CFRO, and Chairman of the Supervisory Board, Mr Rob Zwartendijk, resign from their respective positions. Reason for this decision is that they do not want to and cannot take responsibility for the nationalisation scenario.

In the past few years, Messrs Latenstein and Lamp, together with the organisation and supported by the Supervisory Board, have worked very hard to resolve the issue of the Group’s property finance division. In this process, they consciously worked towards a private solution, because they believe that, from the organisation’s social position, this is the appropriate route. They have done everything in their power to achieve this. They have thus shown their responsibility to safeguard the future of the concern and the interests of the stakeholders. However, the Ministry of Finance has made another choice. The persons in question do not advocate the chosen solution, but respect the choice of the Ministry of Finance. They decided to resign from their positions of their own accord without receiving severance pay and remain available for an orderly transfer.

SNS REAAL regrets the departure of the persons in question, but respects their choice. SNS REAAL is greatly indebted to them for their tireless efforts and expertise with which they served the organisation in recent years. Under their management, a strategic repositioning and social renewal of the organisation was effected. Moreover, they leave behind healthy core activities. Mr Latenstein was CEO and Chairman of the Executive Board of SNS REAAL since 2009. From 2003 to 2009, he was CFO of the organisation. Mr Lamp was CFRO and member of the Executive Board since 2009. Mr Zwartendijk was Chairman of the Supervisory Board of SNS REAAL NV since 2009.

Press release (fonte sito snsreaal)

Vedi l'allegato Press_Release_Announcement_SNS_REAAL.pdf

Descrizione di cosa è successo

SNS REAAL nationalised by Dutch state | Norton Rose

Il decreto di esproprio (fonte governo olandese) http://www.government.nl/documents-...onents-of-sns-reaal-nv-and-sns-bank-nv.html):

in lingua originale Minister Dijsselbloem nationaliseert SNS REAAL | Toespraak | Rijksoverheid.nl

tradotto in inglese Vedi l'allegato decree-by-the-minister-of-finance-regarding-the-expropriation-of-securities-and-capital-componen.pdf

La lettera al parlamento (fonte governo olandese, in inglese qui e in lingua originale qui)

in lingua originale Vedi l'allegato kamerbrief-over-de-onteigening-van-sns-reaal.pdf

tradotto in inglese Vedi l'allegato letter-to-parliament-concerning-nationalisation-of-sns-reaal.pdf

La perizia del Ministro che quantifica l'indennizzo a zero.

Vedi l'allegato petition-to-enterprise-chamber-to-determine-compensation-dated-4-march-2013-unofficial-english-t.pdf

La sentenza del Consiglio di Stato Olandese

Vedi l'allegato Sentenza Consiglio di Stato.pdf

Il comunicato della società con la presa di distanza dal provvedimento e le dimissioni del board

SNS REAAL NV announces that its Executive Board members Messrs Ronald Latenstein, CEO, and Ference Lamp, CFRO, and Chairman of the Supervisory Board, Mr Rob Zwartendijk, resign from their respective positions. Reason for this decision is that they do not want to and cannot take responsibility for the nationalisation scenario.

In the past few years, Messrs Latenstein and Lamp, together with the organisation and supported by the Supervisory Board, have worked very hard to resolve the issue of the Group’s property finance division. In this process, they consciously worked towards a private solution, because they believe that, from the organisation’s social position, this is the appropriate route. They have done everything in their power to achieve this. They have thus shown their responsibility to safeguard the future of the concern and the interests of the stakeholders. However, the Ministry of Finance has made another choice. The persons in question do not advocate the chosen solution, but respect the choice of the Ministry of Finance. They decided to resign from their positions of their own accord without receiving severance pay and remain available for an orderly transfer.

SNS REAAL regrets the departure of the persons in question, but respects their choice. SNS REAAL is greatly indebted to them for their tireless efforts and expertise with which they served the organisation in recent years. Under their management, a strategic repositioning and social renewal of the organisation was effected. Moreover, they leave behind healthy core activities. Mr Latenstein was CEO and Chairman of the Executive Board of SNS REAAL since 2009. From 2003 to 2009, he was CFO of the organisation. Mr Lamp was CFRO and member of the Executive Board since 2009. Mr Zwartendijk was Chairman of the Supervisory Board of SNS REAAL NV since 2009.

Press release (fonte sito snsreaal)

Vedi l'allegato Press_Release_Announcement_SNS_REAAL.pdf

Ultima modifica:

Zorba

Bos 4 Mod

Documenti utili

In questo post inseriremo documenti che potranno esserci utile in futuro (ad es superamento degli stress test, affermazioni delle autorita' olandesi, societa' di rating, etc)

Intervention Act

Financial Supervision Act (del 2009): Vedi l'allegato act-on-financial-supervision.pdf

BCE opinion on crisis intervention measures for financial institutions in difficulty (20/7/2011): Vedi l'allegato en_con_2011_60.pdf

Newsletter su Intervention Act 2012 Vedi l'allegato Intervention Act.pdf

Fitch ratings - SNS Bank N.V. Full Rating Report - March 2012

Vedi l'allegato SNS_Bank_Full_Credit_Report.pdf

La gazzetta del Regno dei Paesi Bassi (in olandese)

Legge del 24 Mag 2012 che modifica la legge sulla vigilanza finanziaria e della legge fallimentare e altre leggi in relazione all'introduzione di ulteriori poteri di intervento nelle istituzioni finanziarie in difficoltà (legge sulle misure speciali società finanziarie)

Vedi l'allegato vj09cklmieyk.pdf

Ultimo bilancio completo (giugno 2012)

Vedi l'allegato SNS_REAAL_Interim_financial_report_2012_16_aug (4).pdf

Q3 2012 Sales and Revenue Call - Trading Update

Source: SNS Reaal

Vedi l'allegato SNS Reaal Sales Teleconference.doc

Emissione di un covered bond ad agosto 2012...tasso poco sopra il 2%...non male per una banca alla frutta e senza valore

Vedi l'allegato SNS_Bank_places_¬_1_billion_of_5_year_Covered_Bonds.pdf

Risultati stress test ottobre 2012: European Banking Authority - EBA - EU Capital Exercise

Vedi l'allegato SNS_EBA_RECAP_2012 NL050-1.pdf

SNS SRLEV S&P.pdf del 16/11/2012

disponibile su richiesta

SR Lev Moody's Credit Opinion.pdf del 26/11/2012

disponibile su richiesta

SNS Reeal Moody's Credit Opinion.pdf del 27/11/2012

disponibile su richiesta

SNS Moodys Credit Opinion.pdf del 29/11/2012

disponibile su richiesta

Rimborso dei certificates del 5/12/2012

con evidenziata la volontà di richiamare anche la serie successiva

Vedi l'allegato Press_release_SNS_Bank_redeems_second_series_of_SNS_Participation_Certificates_20121205.pdf

Moody's: SNS REAAL Credit Focus FAQ Dec12

Vedi l'allegato SNS_REAAL_Credit_Focus_FAQ_Dec12.pdf

Pagina Total Assets di Bloomberg, il giorno della nazionalizzazione

Dati da prendere con le molle perchè BBG è spesso dozzinale nelle sue riclassificazioni.

BNP report about SNS, 8/1/2013

SNS Reaal: unlikely to call subordinated bonds but the 11.25% Tier 1s have upside

Vedi l'allegato BNP SNS_Reaal-8_January_2013.pdf

BNP report about SNS, 23/1/2013

SNS Reaal, the sequel: alternative scenarios

Vedi l'allegato BNP SNS_Reaal-23_January_2013.pdf

Forum olandere e salvataggio dei post in PDF all'8/2/2013

SNS - Waardering van de achtergestelde perpetuals en obligaties - tijd voor research

Forum: Perpetuals, Steepeners » SNS - Waardering van de achtergestelde perpetuals en obligaties - tijd voor research | IEX.nl

Vedi l'allegato IEX.nl.pdf

Blog olandese SOS-NS e salvataggio dei post in PDF all'8/2/2013

nieuwssos-ns.nl | Stichting

Vedi l'allegato sos-ns.nl.pdf

Documenti segreti

Cookies op de websites van RTL Nederland

L'articolo: Vedi l'allegato RTL Nieuws - De geheime documenten over SNS Reaal.pdf

Nel file in allegato ci sono:

-i pdf (credo tutti)

-i pdf in olandesie convertiti in docx

-il sito sotto forma di pdf

-i pdf in olandese convertiti in html (vi permette di tradurli in inglese con buona qualità grazie a google)

Vedi l'allegato sns - i documenti segreti.aggiornamento.zip

Project Mercurius, direttamente dall'account twitter di René Lukassen

Qua ipotizzano al 10/1 un burden sharing al 50% per T1 e raffrontano l'offerta CVC vs la nazionalizzazione.

Vedi l'allegato Project Mercurius - Discussion Materials.pdf

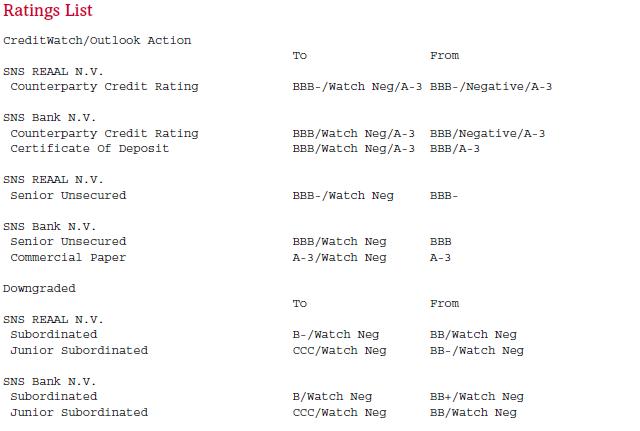

Rating S&P al 29/01/2013

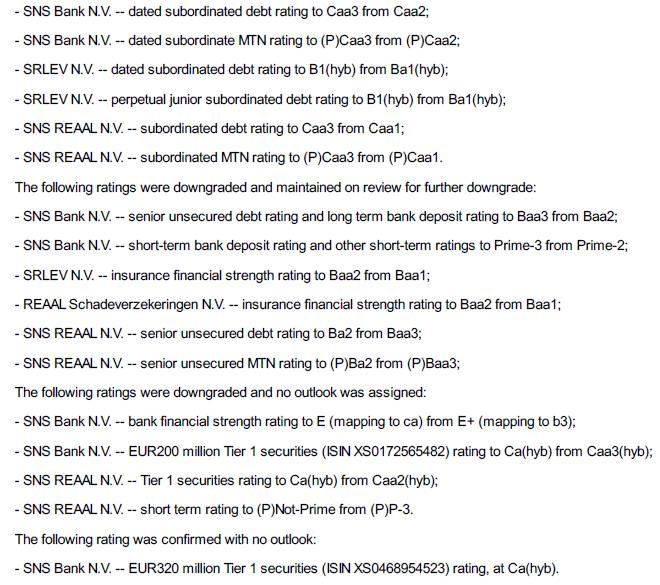

Rating Moody's al 31/01/2013

Rating Fitch al 09/10/12

In questo post inseriremo documenti che potranno esserci utile in futuro (ad es superamento degli stress test, affermazioni delle autorita' olandesi, societa' di rating, etc)

Intervention Act

Financial Supervision Act (del 2009): Vedi l'allegato act-on-financial-supervision.pdf

BCE opinion on crisis intervention measures for financial institutions in difficulty (20/7/2011): Vedi l'allegato en_con_2011_60.pdf

Newsletter su Intervention Act 2012 Vedi l'allegato Intervention Act.pdf

Fitch ratings - SNS Bank N.V. Full Rating Report - March 2012

Vedi l'allegato SNS_Bank_Full_Credit_Report.pdf

La gazzetta del Regno dei Paesi Bassi (in olandese)

Legge del 24 Mag 2012 che modifica la legge sulla vigilanza finanziaria e della legge fallimentare e altre leggi in relazione all'introduzione di ulteriori poteri di intervento nelle istituzioni finanziarie in difficoltà (legge sulle misure speciali società finanziarie)

Vedi l'allegato vj09cklmieyk.pdf

Ultimo bilancio completo (giugno 2012)

Vedi l'allegato SNS_REAAL_Interim_financial_report_2012_16_aug (4).pdf

Q3 2012 Sales and Revenue Call - Trading Update

Source: SNS Reaal

Vedi l'allegato SNS Reaal Sales Teleconference.doc

Emissione di un covered bond ad agosto 2012...tasso poco sopra il 2%...non male per una banca alla frutta e senza valore

Vedi l'allegato SNS_Bank_places_¬_1_billion_of_5_year_Covered_Bonds.pdf

Risultati stress test ottobre 2012: European Banking Authority - EBA - EU Capital Exercise

Vedi l'allegato SNS_EBA_RECAP_2012 NL050-1.pdf

SNS SRLEV S&P.pdf del 16/11/2012

disponibile su richiesta

SR Lev Moody's Credit Opinion.pdf del 26/11/2012

disponibile su richiesta

SNS Reeal Moody's Credit Opinion.pdf del 27/11/2012

disponibile su richiesta

SNS Moodys Credit Opinion.pdf del 29/11/2012

disponibile su richiesta

Rimborso dei certificates del 5/12/2012

con evidenziata la volontà di richiamare anche la serie successiva

Vedi l'allegato Press_release_SNS_Bank_redeems_second_series_of_SNS_Participation_Certificates_20121205.pdf

Moody's: SNS REAAL Credit Focus FAQ Dec12

Vedi l'allegato SNS_REAAL_Credit_Focus_FAQ_Dec12.pdf

Pagina Total Assets di Bloomberg, il giorno della nazionalizzazione

Dati da prendere con le molle perchè BBG è spesso dozzinale nelle sue riclassificazioni.

BNP report about SNS, 8/1/2013

SNS Reaal: unlikely to call subordinated bonds but the 11.25% Tier 1s have upside

Vedi l'allegato BNP SNS_Reaal-8_January_2013.pdf

BNP report about SNS, 23/1/2013

SNS Reaal, the sequel: alternative scenarios

Vedi l'allegato BNP SNS_Reaal-23_January_2013.pdf

Forum olandere e salvataggio dei post in PDF all'8/2/2013

SNS - Waardering van de achtergestelde perpetuals en obligaties - tijd voor research

Forum: Perpetuals, Steepeners » SNS - Waardering van de achtergestelde perpetuals en obligaties - tijd voor research | IEX.nl

Vedi l'allegato IEX.nl.pdf

Blog olandese SOS-NS e salvataggio dei post in PDF all'8/2/2013

nieuwssos-ns.nl | Stichting

Vedi l'allegato sos-ns.nl.pdf

Documenti segreti

Cookies op de websites van RTL Nederland

L'articolo: Vedi l'allegato RTL Nieuws - De geheime documenten over SNS Reaal.pdf

Nel file in allegato ci sono:

-i pdf (credo tutti)

-i pdf in olandesie convertiti in docx

-il sito sotto forma di pdf

-i pdf in olandese convertiti in html (vi permette di tradurli in inglese con buona qualità grazie a google)

Vedi l'allegato sns - i documenti segreti.aggiornamento.zip

Project Mercurius, direttamente dall'account twitter di René Lukassen

Qua ipotizzano al 10/1 un burden sharing al 50% per T1 e raffrontano l'offerta CVC vs la nazionalizzazione.

Vedi l'allegato Project Mercurius - Discussion Materials.pdf

Rating S&P al 29/01/2013

Rating Moody's al 31/01/2013

Rating Fitch al 09/10/12

SNS REAAL:

Long-term IDR: 'BBB+'; remains on RWN

Short-term IDR: 'F2'; remains on RWN

Support Rating: '2' ; remains on RWN

Support Rating Floor: 'BBB+' ; remains on RWN

SNS Bank:

Long-term IDR: affirmed at 'BBB+'; Outlook Stable

Short-term IDR: affirmed at 'F2'

Viability Rating: downgraded to 'bb' from 'bbb-', RWN removed

Senior debt: affirmed at 'BBB+/F2'

Market linked notes: affirmed at 'BBB+(emr)'

Hybrid Tier 1 securities: downgraded to 'B-' from 'B+'; RWN removed

Commercial paper: affirmed at 'F2'

Support Rating: affirmed at '2'

Support Rating Floor: affirmed at 'BBB+'

Dutch government guaranteed securities: affirmed at 'AAA'

SNS REAAL N.V. Insurance Activities:

SRLEV N.V. IFS: 'A-'; remains on RWE

REAAL Schadeverzekeringen N.V. IFS: 'A-'; remains on RWE

Ultima modifica di un moderatore:

Zorba

Bos 4 Mod

Prospetti delle obbligazioni espropriate

SNS Reaal T1 XS0310904155 e SNS Bank T1 XS0468954523

http://www.investireoggi.it/forum/1326059-post147.html

http://www.investireoggi.it/forum/1326199-post148.html

SNS Bank T1, XS0172565482

http://www.investireoggi.it/forum/2139269-post252.html

SNS Reaal T1, XS0382843802

EUR 100 million 8.45% Fixed/Floating Rate Hybrid Capital Securities issued under SNS

REAAL N.V.'s EUR 2,000,000,000 Debt Issuance Programme of 18 August 2008

[missing]

SNS Reaal T2, XS0616936372

http://www.investireoggi.it/forum/2139269-post252.html

SNS Bank LT2 2020 6,25%, XS0552743048

Vedi l'allegato D090_XS0552743048.pdf

SNS Bank LT2 2018 6,625%, XS0363514893

Vedi l'allegato XS0363514893.pdf

SNS Reaal T1 XS0310904155 e SNS Bank T1 XS0468954523

http://www.investireoggi.it/forum/1326059-post147.html

http://www.investireoggi.it/forum/1326199-post148.html

SNS Bank T1, XS0172565482

http://www.investireoggi.it/forum/2139269-post252.html

SNS Reaal T1, XS0382843802

EUR 100 million 8.45% Fixed/Floating Rate Hybrid Capital Securities issued under SNS

REAAL N.V.'s EUR 2,000,000,000 Debt Issuance Programme of 18 August 2008

[missing]

SNS Reaal T2, XS0616936372

http://www.investireoggi.it/forum/2139269-post252.html

SNS Bank LT2 2020 6,25%, XS0552743048

Vedi l'allegato D090_XS0552743048.pdf

SNS Bank LT2 2018 6,625%, XS0363514893

Vedi l'allegato XS0363514893.pdf

Ultima modifica di un moderatore:

Ilmigliore

Osserva e agisci

Avviso ai naviganti

Tutte le informazioni non attinenti la causa/ricorso contro lo stato olandese verranno spostate qua:

http://www.investireoggi.it/forum/s...-notizie-informazioni-e-commenti-vt75255.html

In certi casi non è facile scegliere se spostare o no, cerco di abbondare piuttosto che scarseggiare.

Tutte le informazioni non attinenti la causa/ricorso contro lo stato olandese verranno spostate qua:

http://www.investireoggi.it/forum/s...-notizie-informazioni-e-commenti-vt75255.html

In certi casi non è facile scegliere se spostare o no, cerco di abbondare piuttosto che scarseggiare.

Zorba

Bos 4 Mod

Articoli dal Sole 24 ore.

Colpo di mano dell'olandese Sns: bond espropriati

Colpo di mano dell'olandese Sns: bond espropriati - Il Sole 24 ORE

La «beffa» arriva fino all'Italia

La «beffa» arriva fino all'Italia - Il Sole 24 ORE

Colpo di mano dell'olandese Sns: bond espropriati

Colpo di mano dell'olandese Sns: bond espropriati - Il Sole 24 ORE

La «beffa» arriva fino all'Italia

La «beffa» arriva fino all'Italia - Il Sole 24 ORE

Zorba

Bos 4 Mod

Mi permetto di suggerire a chi non ha ricevuto riscontro del modulo.

Scrivere a [email protected] dalla casella dove volete ricevere la risposta, dando qualche dato per recuperare il modulo (es. nickname, num telefonico inserito e nome primo intestatario). Giusto per evitare abusi

Il nostro Studio ha creato l'account [email protected]. State tranquilli, gli inserimenti ci sono.

Zorba

Bos 4 Mod

Il bonifico si può invece fare fino a lunedì. Esatto?

Sì.

bosmeld

Forumer storico

Dutch court will hear parties on SNS nationalization

on 15 February (Bloomberg)

The top Dutch administrative court will hear on 15

February SNS Reaal NV investors’ appeals of the

government’s decision to expropriate their securities. The

administrative court of the Council of State will rule on the

legitimacy of the nationalization by 25 February at the

latest, said Wendy van der Sluijs, a spokeswoman for the

court in The Hague. As many as 49 appeals had been

filed as of yesterday as 11 February deadline approaches.

on 15 February (Bloomberg)

The top Dutch administrative court will hear on 15

February SNS Reaal NV investors’ appeals of the

government’s decision to expropriate their securities. The

administrative court of the Council of State will rule on the

legitimacy of the nationalization by 25 February at the

latest, said Wendy van der Sluijs, a spokeswoman for the

court in The Hague. As many as 49 appeals had been

filed as of yesterday as 11 February deadline approaches.

la corte sentirà le parti il 15 ,decide sull'esproprio il 25

Ultima modifica di un moderatore:

Users who are viewing this thread

Total: 2 (members: 0, guests: 2)