Articolo decisamente interessante di bloomberg, che tratta alcuni importanti fatti in atto negli ultimi 2-3 mesi nel mercato del credito che dovrebbero ulteriormente invitare alla cautela.

Leverage Rising on Wall Street at Fastest Pace Since ‘07 Freeze

By Kristen Haunss and Jody Shenn

Aug. 28 (Bloomberg) --

Banks are increasing lending to buyers of high-yield company loans and mortgage bonds at what may be the fastest pace since the credit-market debacle began in 2007.

Credit Suisse Group AG and Scotia Capital, a unit of Canada’s third-largest bank, said

they’re offering credit to investors who want to purchase loans.

SunTrust Banks Inc., which left the business last year, is “reaching out to clients” to provide financing, said

Michael McCoy, a spokesman for the Atlanta-based bank.

JPMorgan Chase & Co. and Citigroup Inc. are doing the same for loans and mortgage-backed securities, said people familiar with the situation.

“I am surprised by how quickly the market has become receptive to leverage again,” said

Bob Franz, the co-head of syndicated loans in New York at Credit Suisse.

The Swiss bank has seen increasing investor demand for financing to buy loans in the past two months, he said.

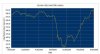

Federal Reserve data show the 18 primary dealers required to bid at Treasury auctions held $27.6 billion of securities as collateral for financings lasting more than one day as of Aug. 12, up 75 percent from May 6.

The increase suggests money is being used for riskier home- loan, corporate and asset-backed securities because it excludes Treasuries, agency debt and mortgage bonds guaranteed by Washington-based Fannie Mae and Freddie Mac of McLean, Virginia or Ginnie Mae in Washington. Broader data on loans for investments isn’t available.

Before Bear

The increase over that 14-week stretch is the biggest since the period that ended April 2007, three months before two Bear Stearns Cos. hedge funds failed because of leveraged investments. The world’s largest financial institutions have taken $1.6 trillion in writedowns and losses since the start of 2007, helping to trigger the worst financial calamity since the 1930s, according to data compiled by Bloomberg.

Lending to purchase loans rated below investment grade and mortgage bonds is part of this year’s recovery in credit markets. Companies sold $889 billion of corporate bonds in the U.S. this year, a record pace, Bloomberg data show. The Standard & Poor’s 500 Index rose 52 percent since March 9, the best rally since the Great Depression.

Some areas of the credit market haven’t returned to the levels from before the collapse in real estate. Lenders are also requiring more collateral for loans.

Drop in Loans

Banks arranged $61.8 billion of leveraged, or high-yield, loans this year, a 74 percent decline from the same period in 2008, and 91 percent lower than two years ago, Bloomberg data show. Leveraged loans are rated below Baa3 by

Moody’s Investors Service and BBB- by

S&P of New York. No bonds containing new mortgages have been sold this year, except those with government backing, according to industry newsletter

Inside MBS & ABS of Bethesda, Maryland.

The Fed data on loans by primary dealers is down from $113.8 billion in 2007. The data reflects so-called reverse- repurchase financing, securities-lending agreements and other arrangements.

Financing purchases of assets is filling cracks left by the government, whose lending programs to end the recession didn’t address some of the riskiest parts of the consumer and corporate debt markets.

The Fed’s $1 trillion Term Asset-Backed-Securities Loan Facility can’t be used to buy residential mortgage bonds and leveraged loans. The Treasury Department’s $40 billion Public- Private Investment Program excludes the loans and mortgage bonds that are repackaged into new securities.

‘Political Pressure’

“There is a lot of political pressure on banks to lend and this is one form,” said

Ratul Roy, head of structured credit strategy at Citigroup in New York.

The Fed and government programs prompted sales of securities backed by auto loans, credit cards, equipment leases and auto-dealership debt.

Yields on top-ranked debt backed by auto loans and credit cards have fallen by as much as 2 percentage points relative to benchmark rates. The yield premium has shrunk to less than 1 percentage point since TALF began in March, according to Charlotte, North Carolina-based Bank of America Corp. data. The average

interest rate on loans for new cars declined to 3.88 percent in June, from 8.23 percent in January, Fed data show.

The Fed is also buying as much as $1.25 trillion of so- called agency mortgage bonds. Fixed-rate, 30-year mortgages to borrowers with good credit who put money down are 5.29 percent, according to North Palm Beach, Florida-based Bankrate.com, or 1.85 percentage points more than 10-year Treasuries. The gap was 3.05 percentage points at the end of 2008.

Leveraged-Loan Prices

The increase in bank financing tracks a rebound in demand for securities and assets.

Prices for leveraged loans tumbled to a record low 59.2 cents on the dollar on average Dec. 17, before rebounding to 83.5 cents on Aug. 27, according to the S&P/LSTA U.S. Leveraged Loan 100 Index.

As much as 5 cents of the gains are partly attributable to “leverage coming back into the system,” according to Franz at Zurich-based Credit Suisse.

The senior-most bonds backed by adjustable-rate Alt-A home loans, or those with little to no documentation of a borrower’s finances, have jumped to 52 cents, from a low of 35 cents in March, according to Barclays Plc in London. Top-rated commercial-mortgage securities soared to 90 cents on average, from 72 cents in February, Merrill Lynch & Co. index data show. Merrill is a unit of Bank of America.

Credit Losses

The risk now is that new credit leads to more losses at a time when consumer and corporate default rates are rising. Company defaults may increase to 12.2 percent worldwide in the fourth quarter, from 10.7 percent in July, according to new York-based Moody’s.

U.S. financial institutions probably will report more credit losses as commercial real estate falters through next year,

James Wells III, the chief executive officer at SunTrust, Georgia’s biggest lender, said in an Aug. 24 speech to the Rotary Club of Atlanta.

“If you lever up an asset at these already elevated prices, and the underlying fundamentals, like termites, start to chew through the performance of the security, at some point it becomes unsustainable,” said Julian Mann, who helps oversee $5 billion in bonds as a vice president at First Pacific Advisors LLC in Los Angeles.

No Thanks

Chimera Investment Corp., the New York-based mortgage-debt investor that raised $1.5 billion by selling stock last quarter to buy devalued assets, hasn’t taken banks up on their loan offers in part because the company isn’t sure it would be able to continue “rolling” the financing when it matures, said Matthew Lambiase, the company’s CEO.

The lack of a “robust” market means lenders may have too much power to change terms, Lambiase said on a July 30 earnings

conference call with investors and analysts.

Investments held with borrowed money by funds including Santa Fe, New Mexico-based

Thornburg Mortgage Inc. and Peloton Partners LLP of London slammed the markets as retreating prices made banks wary about getting repaid.

That triggered margin calls, collateral seizures and obligations to unwind, fueling the downward spiral in credit markets. Thornburg, a 16-year-old home lender, filed for Chapter 11 bankruptcy protection in May. Peloton, a hedge-fund firm run by former Goldman Sachs Group Inc. partners, shut its $18 billion ABS Fund.

Money Down

Financing terms are more stringent than before credit markets seized up.

Investors seeking loans to buy non-agency home-loan bonds typically must put down 35 percent to 50 percent, according to four investors and bankers whose firms are using or providing the leverage and didn’t want to be named because the negotiations are private.

That compares to as little as 3 percent for top-rated mortgage bonds before the markets collapsed, according to

Laurie Goodman, an analyst at Amherst Securities Group LP in New York. She was among Institutional Investor’s top-rated fixed-income analysts while at Zurich-based UBS AG from 2000 to 2008.

Banks are typically offering as much as $3 in financing for every $1 of equity investors in leveraged loans contribute, down from $6 to $7 before mid-2007,

Barry Delman, a New York-based managing director of structured credit products at Scotia Capital, said in reference to so-called total return swaps. Scotia Capital is a unit of Bank of Nova Scotia in Toronto.

The swaps are a type of derivative where a bank passes on returns or losses from a pool of loans to an investor.

Citigroup, JPMorgan

The interest rate that investors are now being charged is usually between 2 percentage points and 2.75 percentage points more than the London interbank offered rate, according to Delman. Three-month Libor, or what banks charge each other for loans in dollars, was set at 0.36 percent yesterday, according to the British Bankers’ Association.

Derivatives are contracts whose values are tied to assets including stocks, bonds, commodities and currencies, or events such as changes in interest rates or the weather.

JPMorgan and Citigroup, the second- and third-largest U.S. banks by assets, are offering similar terms, according to investors.

Tasha Pelio, a spokeswoman at JPMorgan, and

Jeanette Volpi, a Citigroup spokeswoman, declined to comment. Both banks are based in New York.

“To the degree leverage coming back represents a normalization of the markets, it’s a good thing,” said

Michael Youngblood, a former mortgage-bond analyst who last year co- founded hedge fund Five Bridges Advisors LLC in Bethesda, Maryland. “But the idea it should be part of any permanent residential-mortgage-securities portfolio strategy is unwise.”